By MADDIE FRUMAN

Staff Writer

Most people know about the existence of a gender wage gap in the United States, in which a woman makes 84 cents for every dollar a man makes. Fewer people are aware of the financial discrimination in the market for women’s products.

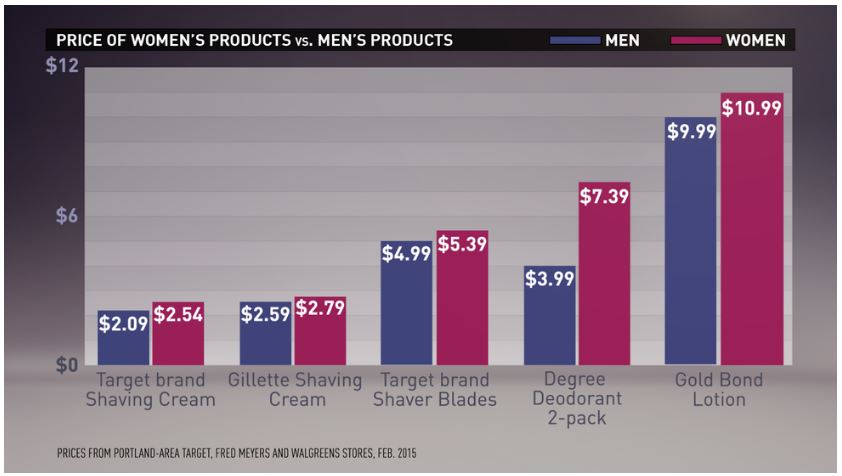

Countless stores market products “for women” that are virtually identical to but more expensive than their male counterparts. In a study conducted by New York City’s Department of Consumer Affairs (DCA), which analyzed over 90 different brands and 800 individual products, it was found that women’s products consistently cost more than similar products for men. This phenomenon is known as the “pink tax.”

The DCA study had some shocking findings, showing the pervasiveness of the “pink tax” throughout a woman’s entire life. Baby clothes for girls cost 13% more than those for boys, and toys were found to be 11% more expensive for girls, even if they are just different-colored versions of the same toy.

For personal care items, the numbers were the most staggering. The study showed that 56% of the time, women pay more than men for similar personal care products, such as razors or deodorant. The study also found that, on average, these products are charged 13% higher for women than for men, even if the ingredients are comparable. The most startling statistic is the whopping 48% more that women pay for their shampoo than men, with the only difference between the male and female versions being the scent.

This price discrepancy for everyday products is only compounded by the other expenses that arise from being female. Women have to pay unreasonable prices for necessities such as bras, menstrual products and birth control. The average bra costs $40, and birth control pills can cost up to $50 per month, according to Planned Parenthood. Each box of menstrual products, which lasts one or two monthly cycles, costs around $7. On top of it all is the “tampon tax,” effective in 40 states, which is a luxury tax placed on all menstrual products. Certain items, such as food or prescription medications, are classified as “necessities” and thus exempt from sales taxes. Menstrual products are not recognized by law as necessities, but rather as “luxury” items, and are subsequently taxed. This is unfair and discriminatory to women, to whom periods are certainly not a “luxury.” Women should not be taxed for having periods, a bodily function they have no control over. The most ironic fact is that in most states, including California, Viagra is deemed a necessity and exempt from taxes, but tampons are not.

Though these issues are being brought to attention, reform is still minimal. Many states have laws prohibiting “pink tax” on services, such as haircuts or dry-cleaning, but these laws do not reach off-the-shelf products at the store. A year ago, California Assemblywoman Cristina Garcia wrote a bill that would exempt tampons and other feminine hygiene products from taxes, which was unanimously approved by the state legislature. In an effort to save money, the bill was vetoed by Governor Jerry Brown, and the tampon tax has remained ever since.

These price phenomena only make the wage gap more problematic: if women are paid less but charged more for products, how can they get enough economic agency to equal men? This disparity in economic treatment needs to be addressed as women move forward to achieving true equality.

Being a woman is expensive

February 9, 2018

0

Donate to Sword & Shield

$180

$1000

Contributed

Our Goal

Your donation will support the student journalists of University High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

More to Discover